Life Insurance is simple - pay a relatively small premium to protect against catastrophic loss.

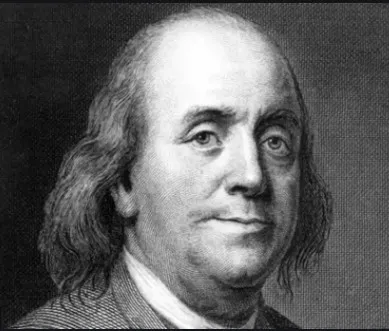

Benjamin Franklin was probably the first insurance salesman in America. Back in 1752 he and other prominent Philadelphians formed an insurance company to insure against losses from fire.

Back then, as now, reducing risk to one person by spreading the risk among many is the cornerstone principal of insurance.

We buy fire insurance to spread the risk of our house burning down. We buy life insurance to spread the risk of a breadwinner, or business partner dying early, and we buy disability insurance to spread the risk of becoming disabled.

For the payment of a relatively small premium, we are able to reduce the risk of catastrophic losses.